If you’re a US-based company trying to hire beyond your home state or beyond the US entirely “EOR software” is one of the fastest ways to turn a candidate into a compliant employee without drowning in payroll registrations, benefits admin and employment-law complexity.

But not all EOR platforms are equal: some are essentially service firms with a portal while others are true software-led systems that give you visibility, controls, clean integrations and audit-ready workflows.

This master guide combines foundational education with buyer-level decision support. It’s designed for US founders, HR and People Ops leaders, Finance teams, and Legal stakeholders who need to understand what EOR software is, when to use it, how to evaluate providers, and how to choose confidently.

What Is EOR Software?

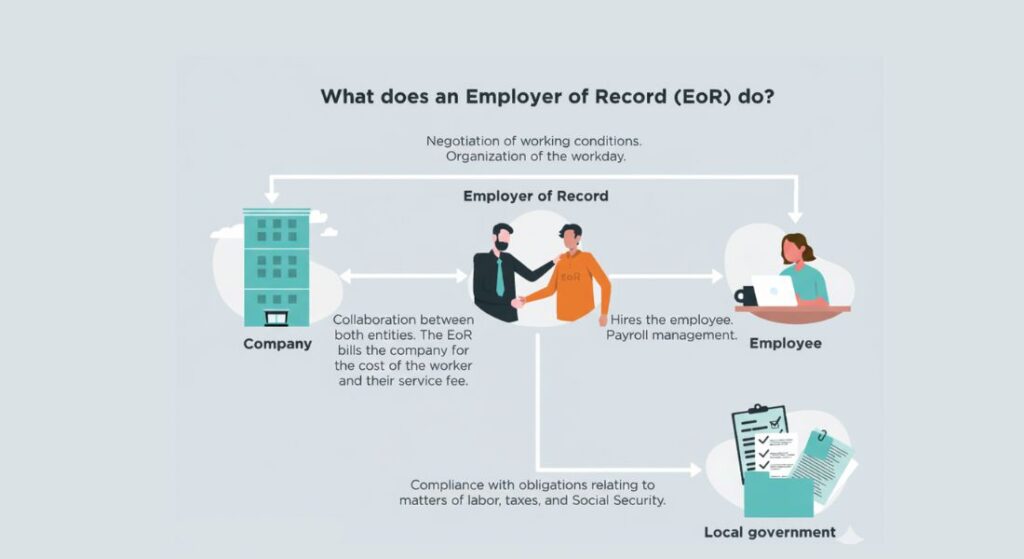

EOR software is a platform that helps a company employ workers through an Employer of Record (EOR)—a third party that becomes the worker’s legal employer for payroll and compliance purposes while your business directs the employee’s day-to-day work.

In practice, EOR software combines two critical layers:

- The software platform – onboarding workflows, employment contracts, payroll calculations, benefits administration, reporting, permissions and invoicing.

- Operational execution – local entities, in-country compliance expertise, payroll processing, statutory filings and required documentation handled by the EOR.

For US companies, this model solves a fundamental challenge: hiring employees in other countries without forming and maintaining local legal entities.

EOR Software vs “Just an HR Tool”

EOR software is not simply a digital employee file cabinet or a lightweight HR system. While traditional HR tools focus on storing employee data, EOR software is designed to manage the legal, financial and compliance realities of global employment.

A true EOR platform should help US companies answer critical operational and governance questions, such as:

- What is the fully loaded cost of this hire in a specific country or US state?

- What compliance steps are required before the employee’s start date?

- Who is responsible for each employment document, notice and statutory filing?

- Can Finance reconcile invoices to payroll outputs and employer costs?

- Can Legal and HR audit changes, approvals and user access over time?

If a platform can’t clearly answer these questions, it’s functioning as an HR tool not as EOR software.

| Question a Real EOR Platform Answers | HR Tool Only | EOR Software |

| What is the fully loaded cost? | ❌ | ✅ |

| What compliance steps are needed? | ❌ | ✅ |

| Who owns the documents & filings? | ❌ | ✅ |

| Can Finance reconcile payroll & invoices? | ❌ | ✅ |

| Can Legal / HR audit approvals? | ❌ | ✅ |

Who Typically Uses EOR Software in the US?

EOR software is most commonly adopted by US businesses that need speed, compliance, and visibility when hiring beyond their existing footprint.

Startups and Scaleups

US startups hiring their first international employees use EOR software to avoid entity setup while staying compliant from day one.

US Tech Companies with Distributed Teams

Technology companies build global teams across Engineering, Sales and Customer Support using EOR platforms to centralize payroll, compliance and reporting.

Mid-Market Companies Expanding Internationally

Mid-sized businesses entering new countries rely on EOR software to test markets quickly without long-term legal commitments.

Enterprises Standardizing Global Employment

Large organizations use EOR software to create a consistent, auditable employment model across regions often while consolidating multiple local vendors.

How EOR Software Works for US Employers (Step-by-Step)

Even though EOR providers market “end-to-end” the best way to understand EOR software is to view it as a workflow engine across the employee lifecycle.

Step 1: Hiring scope and compliance check

Before an offer is issued, the EOR platform confirms:

- Country or state feasibility

- Employment classification (employee vs contractor)

- Required documents, notices, and timelines

Step 2: Contract Creation And Localized Employment Terms

The Employer of Record generates locally compliant employment contracts aligned with in-country labor laws. These reflect statutory requirements such as probation periods, notice terms, working hours, and termination protections.

Step 3: Onboarding And Document Collection

A structured onboarding workflow gathers:

- Personal and identity information

- Local tax forms or equivalents

- Bank details for payroll

- Benefits selections (where applicable)

Many EOR onboarding descriptions follow a consistent flow: contract setup → payroll setup → benefits enrollment.

Step 4: Payroll Setup, Tax Withholding, And Pay Runs

For US employers, payroll tax withholding obligations are a core compliance requirement. The IRS notes that employers are required by law to withhold employment taxes from employees including federal income tax withholding and Social Security/Medicare taxes.

In an EOR arrangement, the EOR is typically the employer responsible for running payroll for those workers (depending on the contract and jurisdiction).

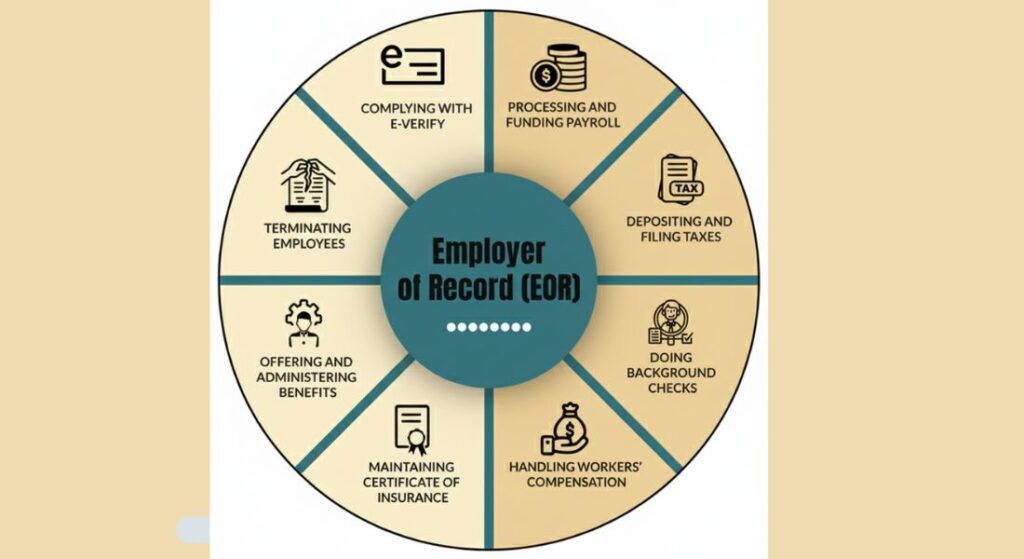

Step 5: Benefits Administration And Ongoing Hr Changes

EOR platforms may support:

- enrollment workflows

- deductions and employer contributions

- PTO tracking (varies by vendor)

- compensation changes and approvals

Step 6: Offboarding And Final Pay Workflows

Offboarding is where weak EORs create the most pain. Strong platforms provide:

- termination workflows aligned to local rules

- final pay calculations

- documentation tracking

- benefits continuation triggers

Why US Companies Are Rapidly Adopting EOR Software

This is the section many “best EOR software” posts gloss over and it’s where US buyers make expensive mistakes.

Flexibility to Scale Without Setting Up Entities

EOR software allows US businesses to hire and manage international employees without establishing foreign legal entities. Companies can scale headcount up or down in different countries as needed without long-term infrastructure costs or exit complexity.

Built-In Compliance Expertise

With EOR software, the Employer of Record assumes primary responsibility for local labor laws, payroll taxes and statutory benefits. This reduces misclassification risk, helps ensure regulatory compliance and protects US companies from penalties and future legal liabilities.

Simplified Global Hiring Operations

EOR software removes HR, payroll, tax, benefits and compliance administration from internal teams. By centralizing global employment in one platform, companies can focus on core business growth instead of managing international employment complexity.

EOR Software vs PEO vs Staffing Agency: What US Companies Should Choose

A PEO generally operates on a co-employment structure while an EOR legally employs the workforce. If you already have a US entity and your main goals are better benefits and HR admin, you may be looking for a PEO not an EOR.

A staffing agency is often best for temporary, project-based staffing while EOR is designed for compliant employment without needing to establish local entities.

| Feature / Criteria | EOR Software | PEO | Staffing Agency |

| Legal Employer | EOR is legal employer | Co-employment | Agency is legal employer |

| International Hiring | Yes, supports multi-country hiring | Limited / Domestic only | Usually domestic only |

| Foreign Entity Required | No | Yes | No |

| Compliance Ownership | EOR handles fully | Shared responsibility | Agency handles temporary staffing |

| Payroll & Benefits | Managed by EOR | Shared or via PEO | Managed by agency |

| Best For | Global hiring, scaling fast | Domestic HR & benefits administration | Temporary/project-based work |

| Limitations | Requires platform selection | Only works where entity exists | Limited control, higher long-term cost |

Rule of thumb: If you want ongoing employees and want to manage them like your team (but without forming entities), you’re usually in EOR territory.

When US Companies Should (and Shouldn’t) Use an Employer of Record

EOR software tends to be the best fit when speed and compliance matter more than building long-term internal infrastructure immediately.

Use EOR software when you need to:

- hire internationally without forming foreign entities

- enter a new market fast (sales, support, engineering pods)

- reduce compliance risk and administrative workload

- centralize payroll and employment operations across many countries

- support a lean HR/Legal function with scalable processes

Some EOR providers position EOR as a way to hire in the US (or in new US locations) while outsourcing payroll and compliance administration.

Situations where EOR might be the wrong tool

- You only hire contractors

- You already operate entities in all hiring locations

- You want to manage all payroll and compliance in-house

US Compliance Reality Check: What EOR Software Helps With (and What It Doesn’t)

EOR software is a compliance accelerator not a magic wand. It can reduce risk by standardizing workflows and placing legal employer obligations with the EOR but your company still needs governance.

Payroll taxes and withholding (US lens)

Employers are required by law to withhold employment taxes from their employees. If you’re using an EOR for US employment confirm contractually:

- who is responsible for withholding/remitting

- who issues wage statements and year-end forms

- what visibility you get into calculations and filings

Wage and hour requirements (FLSA)

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping and youth employment standards. EOR platforms vary widely in how much they help here:

- some provide policy guidance and time tracking integrations

- others simply run payroll and leave compliance decisions to you

Form I-9 obligations

USCIS states employers must have a completed Form I-9 on file and retain it for required periods. If the worker is in the US ask:

- who completes Section 2 within the required timeline

- where the I‑9 is stored

- what happens in an audit

Workers’ compensation (state-by-state)

Workers’ comp requirements vary by state and most states require coverage. In an EOR model, the EOR often carries the policy but you need confirmation for each state where you employ.

COBRA

COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer continuation coverage in certain cases. If benefits are offered through the EOR clarify:

- whether COBRA applies and how notices are handled

- who the plan administrator is

- what your responsibilities are as the client

Vendor security expectations (SOC 2 Type II)

If your EOR platform handles sensitive employee data many buyers look for SOC 2 Type II. A common description is that SOC 2 Type II evaluates the operating effectiveness of security controls over a period of time. Ask for scope and report period (not just a badge on a website).

EOR Software Feature Checklist: Must-Haves vs Differentiators

This section is intentionally practical. Use it as your on-page “buyer checklist” to outperform competitor posts.

Must-have EOR software features

1) Transparent payroll and employer-cost breakdowns

You should be able to see:

- gross-to-net calculations

- employer taxes and statutory costs

- benefits costs

- platform/service fees

- invoiced totals reconciled to payroll

2) Compliance workflows and documentation tracking

At a minimum:

- onboarding checklist visibility

- required document capture

- status tracking (pending/approved)

- audit logs

3) Employee self-service

- Employees should be able to:

- update personal info

- access pay slips

- manage tax/withholding details (where applicable)

- access benefits info

4) Role-based access control + auditability

Finance should not have the same permissions as HR; managers should not see unnecessary personal data. This is critical for internal controls.

5) Integrations that reduce duplicate work

Your EOR software should integrate with:

- HRIS

- accounting

- identity management (for access provisioning)

- time tracking (if relevant)

Differentiators that separate “good” from “best”

- Advanced reporting by country and cost center

- Practical local guidance (not just marketing copy)

- Mature support SLAs

- Clean, compliant offboarding workflows

EOR Pricing: Typical Models, Ranges, and What Drives Cost

EOR pricing typically follows one of two structures:

- Flat fee per employee per month

- Percentage of payroll

Public pricing discussions commonly cite broad ranges depending on country and service level. For example, SelectSoftwareReviews notes fixed fees often fall between $300–$1,000 per employee per month (with best-in-class often around the $500 range).

Another provider-focused guide notes pricing can start lower and move higher depending on service levels.

What drives EOR cost up

- complex statutory benefits and payroll rules

- multi-currency / FX handling

- equity administration (often outside scope)

- high-touch HR support or immigration support

- frequent changes: promotions, bonuses, variable comp

- challenging terminations/offboarding requirements

The invoice transparency test (do this before you sign)

Ask every vendor to provide a sample invoice showing:

- employee salary and gross pay

- employer taxes/statutory costs

- benefits premiums and employer share

- EOR fee

- any FX spread or transfer fees

If they can’t provide a clear example, the “real cost” will surprise you later.

How to Evaluate EOR Software: Demo Questions + Scorecard

Buyer Scorecard (Suggested Weighting)

- Compliance depth: 25%

- Payroll accuracy and transparency: 20%

- Coverage and scalability: 15%

- Product UX and automation: 15%

- Support model and SLAs: 15%

- Security and audits: 10%

Demo Questions That Reveal Weak Platforms

- Show a full gross-to-net payroll breakdown

- Walk through onboarding and approvals

- Explain offboarding and final pay handling

- Show permissions and audit logs

- Explain compliance coverage vs client responsibility

Implementation Plan: 30/60/90 Days to Launch

First 30 Days: Get Aligned Internally

- define hiring geographies and worker types

- align HR + Legal on policies (time off, notice expectations, IP)

- define system-of-record (what lives in HRIS vs EOR platform)

- build an internal approval workflow (Hiring Manager → HR → Finance → Legal)

60 days: integrate and pilot

- connect HRIS/accounting (even basic exports are a start)

- pilot 1–3 hires in one geography

- validate invoice reconciliation + employee experience

- stress-test support response times with real requests

90 Days: Scale And Standardize

- document onboarding/offboarding SOPs

- implement quarterly vendor governance (SLAs, security, process changes)

- create playbooks for promotions, transfers, and terminations

| Phase | Key Activities | Expected Outcome |

| First 30 Days | Define hiring geographies, worker types, policies; set approval workflow | Alignment across HR, Legal, Finance |

| Next 60 Days | Integrate HRIS/accounting; pilot hires; validate invoices & experience | Pilot success, operational confidence |

| Next 90 Days | Scale hires; document SOPs; quarterly governance; promotion/termination playbooks | Standardized, auditable global operations |

Common EOR Buying Mistakes (and How to Avoid Them)

- Buying EOR when a PEO is sufficient

- Failing to clarify I-9 and payroll tax responsibilities

- Assuming “compliance is included” without defining scope

- Choosing based on price instead of operational reliability

Examples of US Businesses Using an Employer of Record

Many US companies use an Employer of Record (EoR) to hire international talent while avoiding the complexity of setting up local entities. Near acts as the Employer of Record for US businesses hiring top Latin American (LatAm) talent managing legal employment, compliance, payroll and HR operations on their behalf.

CyberFortress

CyberFortress is a US-based data backup and recovery company that delivers advanced technology solutions to help organizations protect and manage critical data. As a people-first organization, CyberFortress hires remote professionals across Latin America.

Near serves as the Employer of Record handling all legal employment responsibilities, regulatory compliance, payroll and HR administration allowing CyberFortress to scale its global workforce efficiently and compliantly.

Park Street

Park Street is a US service provider specializing in back-office solutions, advisory services and working capital support for the wine and spirits industry. Through an EoR partnership with Near, Park Street hires skilled LatAm professionals without establishing local entities. Near manages employment compliance, HR processes and payroll, enabling Park Street to access high-quality international talent while staying focused on client delivery and growth.

Conclusion

EOR software is no longer a niche HR workaround it’s a strategic infrastructure layer for US companies hiring and scaling globally. The right platform delivers speed, compliance confidence, financial clarity and operational control.

But outcomes depend on selection. Companies that treat EOR as “just a vendor” often face hidden costs, compliance gaps and painful offboarding events. Those that evaluate platforms rigorously gain a durable advantage.

Ready to Hire Globally with Confidence?

If you’re planning to hire outside the US or scale distributed teams quickly EOR software can remove the friction that slows growth. Use this guide to evaluate providers carefully, ask better questions and choose a platform that supports both compliance and scale.

FAQs

Is EOR software only for international hiring?

No, it’s most often used for international hiring, but some companies use it for US employment depending on the provider’s coverage and structure.

Does an EOR eliminate compliance risk?

It reduces operational burden and may shift certain legal employer obligations to the EOR, but your company still needs oversight, vendor governance, and strong internal controls.

Is EOR software legal for US companies?

Yes. EOR software is widely used by US companies when provided by compliant partners.